UCMK is with you along the way – from ideas to results

Trustworthy

Experienced

Professional

What we Do

Individual & Corporates Accounting Services

AUDIT SERVICES

We perform audits in accordance with generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

TAX SERVICES

A significant factor in selecting a qualified firm is its ability to provide proactive tax advice.

MANAGEMENT CONSULTING SERVICES

Operations Management refers to a wide range of services that enhance our clients’ efforts to meet performance and profitability objectives. From a complete reengineering of all business processes to specific improvements in critical business functions—such as costing and quality management, we work with you to identify improvement opportunities and then to implement any necessary changes.

UCMK & ASSOCIATES – YOUR TRUSTED CPA FIRM!

At UCMK

We understand that success is often not an option. Our mission is to help our clients navigate successfully through the opportunities and challenges they face as they seek to stay ahead of the competition. Our motto is simple and direct –

“We want to be our clients’ most trusted business advisor”

– by delivering top notch services at fees you can afford.

자본 투자 이득과 손실 (Capital Gains and Losses)

9/27/12 (Thu) Column - Koreatown Daily 개인이나 법인이 투자목적으로 소유하고 있는 부동산, 주식, 공사채, 귀금속 등을 자본자산(Capital Assets)이라 한다. 자산을 매각할 때 원가와 판매가의 차이에 따라 손익 여부가 가려며 이득에 대해서는 보통 세금이 부과되며 손실은 어느 선에서 공제가 가능하다. 자본이득(Capital Gain)이란 자본자산의 가격상승으로 생기는 차익을 말하는데, 이 가치의 증가는 단순한 평가액의 상승 혹은,...

의료비용(Medical Expense)

9/27/2012 Column - Korea Daily 개인이 지출한 의료비용은 개인세금보고 시 항목별 공제(Itemized Deduction) 항목으로 세금 공제를 받거나 또는Flexible spending accounts(FSA), Health reimbursement accounts(HRA), 또는 Health savings accounts(HSA)등 세전 공제(Pre-tax deduction) 방법으로 지출된 금액만큼 보상을 받는 방법을 통하여 세금 공제 혜택을 받을...

비즈니스 비용 공제

10/04/2012 Column - Koreatown Daily 비즈니스를 하면서 공제할수 있는 비용은 크게 4가지이다. 첫째 창업비(Start-up Expenses), 둘째 운용비용(Operating Expenses), 세째 자본비용(Capital Expenses), 네째 재고원가(Inventory Costs) 이다. 창업비(Start-up Expense)는 사업을 처음 시작하기 위해 발생한 비용이다. 창업비에는 면허 비용, 광고비용, 변호사 회계사 비용, 여행 비용, 시장...

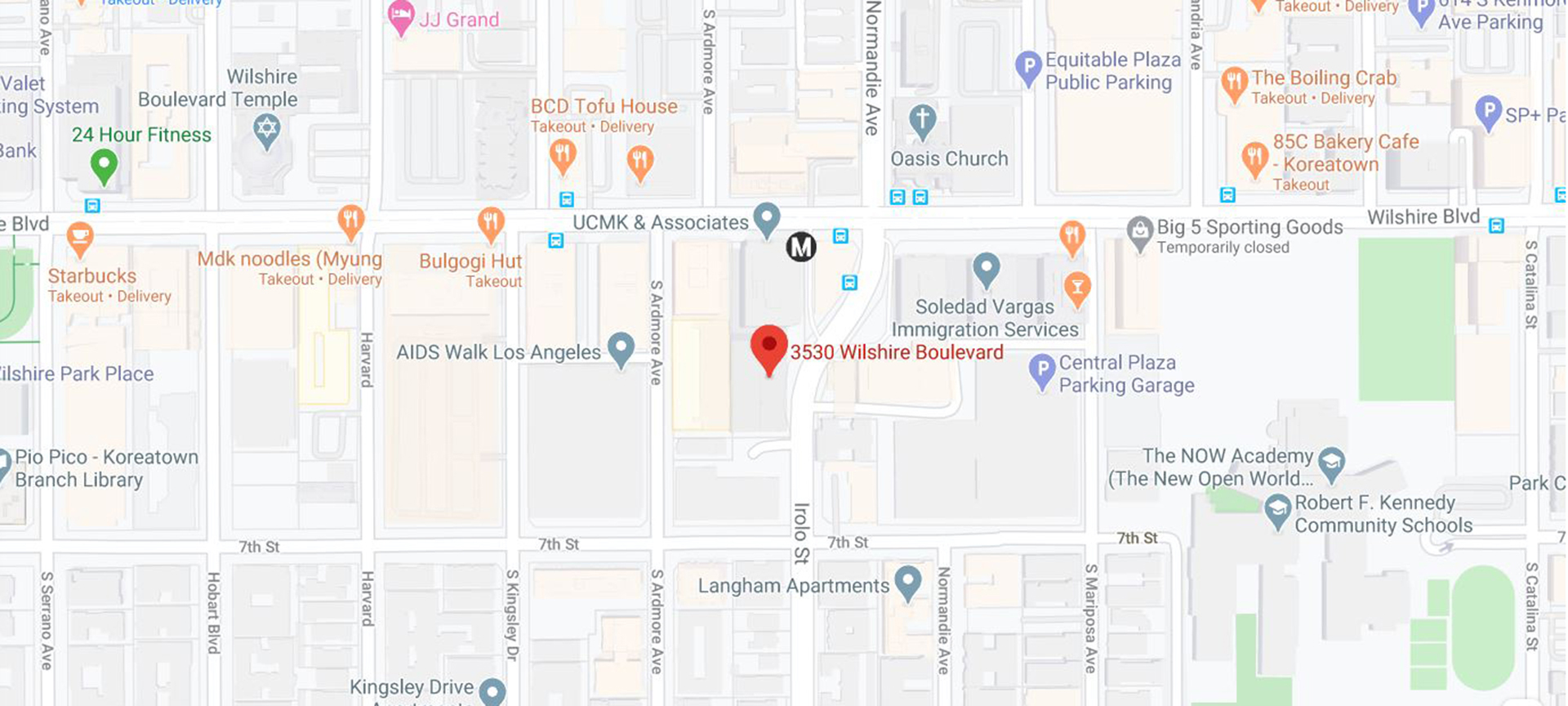

Contact Us

info@ucmkcpa.com

(213) 388 8943

3530 Wilshire Boulevard, Suite 1510, Los Angeles, CA 90010

Mon-Fri: 9am-6pm, Sat-Sun: Closed